Dont Cut Your Marketing Budget in a Recession.

由於COVID-19.疫病尚未取得完全的消除與控制,對於全球經濟復甦與生產者及消費者而言,都是新的挑戰,企業家對市場行銷的計劃與管理,同樣的遇到新的問題,必須解決,謀求企業生存發展之道,本文的意圖是以企業界的實例說明,如何因應當前的危機突破並得到成績.這是哈佛大學商學院,一系列研究因為新冠疫病,造成對全球為經濟復甦與生產者及消費者的研究課題,筆者將陸續轉載發表,提供讀者們參考.

在經濟衰退時削減行銷預算,似乎是一種直覺反應,但其實是飲鴆止渴。根據研究,在此時增加行銷預算的企業,反而可以逆勢成長。在經濟衰退剛過中點而邁向復甦時,也適合推出集中資金研發的新商品。此外,依據客觀條件與所在區域的局勢,重新分配行銷預算,也會獲得成功。現在不是停止花錢的時候,而是改變花錢方式的時候。

大多數公司在經濟衰退期間減少支出,尤其是較容易削減的行銷項目.。目前許多廣告代理商正勉力維持營運,而Google和Facebook)示自家的廣告收入大幅減少,因為行銷支出隨著景氣循環而驟減。但這等於是古代放血療法的現代版,放血是過去曾廣為使用的舊式治療方法,其實反而會降低病患對疾病的抵抗力。

研發和新產品上市:即使在經濟繁榮時期,新產品上市也會有風險而且在任何公司裡,內部總是會有很多爭論,探討正在開發的多項新產品當中,應選擇哪些真正投入市場。在這種情況下,在經濟衰退期間砍掉新產品開發計畫,似乎是毫無疑問可去做的事。

價格與促銷:面對銷售量下降,企業主管會非常想提高售價,希望能藉此維持營收和利潤。我們不難看出為什麼漲價是壞主意:隨著經濟衰退使消費者對價格更加敏感,任何漲價行為,都會進一步降低商品售出的可能性,因此漲價的公司很快就會舉辦價格促銷活動,以扭轉漲價的後果。但研究顯示,價格若是這樣時漲時跌,會造成反效果:相較於沒有這麼做的公司,有這麼做的公司失去更多的市場占有率。

國際企業界對於廣告市場行銷計劃沉著小心應付,當前的經濟危機在夜間其廣告招牌依舊亮閃閃.經濟衰退期間的廣告內容,必須反映出消費者遭遇的挑戰。消費者在經濟低迷時期,希望看到品牌展現團結精神,以俄羅斯一家大型綜合企業集團為例,我們在2008年全球金融危機期間及之後擔任它的顧問。它的營運範圍涵蓋六個國家和六個產業(包括主流服裝和專業金融服務業)。針對它在俄羅斯的主流服裝品牌,該公司維持廣告預算,而其他品牌(大多是外國品牌)直接刪減廣告訊息的數量,至於保留下來的廣告,幾乎都沒有改變訊息的內容。這個做法對該公司非常有效,因為它既有的定位是物有所值的在地品牌,而當時花錢購買外國奢侈品會令人感覺不妥,看起來也不妥,因此它的定位能夠吸引消費者。隨著經濟衰退逐漸過去,之前由較昂貴的外國服裝品牌轉過來消費的許多新顧客,仍繼續支持這個在地品牌。這家綜合集團在羅馬尼亞的銀行業務,採用非常不同的做法創造出雙贏的局面.

.

Don’t Cut Your Marketing Budget in a Recession.

Most companies reduce spending in recessions, especially on marketing items that may be easier to cut (certainly relative to payroll). Right now, advertising agencies are struggling to stay afloat, and Google and Facebook are reporting substantially lower ad revenues as marketing spending dives with the business cycle (cyclical marketing). But that is today’s equivalent of bleeding – an old-fashioned but once widespread treatment that actually reduces the patient’s ability to fight disease.

Companies that have bounced back most strongly from previous recessions usually did not cut their marketing spend, and in many cases actually increased it. But they did change what they were spending their marketing budget on and when to reflect the new context in which they operated. Let’s begin by taking a look at the various categories of marketing costs.

R&D and new product launches:New product launches are risky even in boom times, and there is always considerable debate within any firm about which of the many new products under development should actually go to market. In this context, axing new product development projects in a recession looks like a no-brainer.

But research in contexts as different as U.K. fast-moving consumer goods and U.S. automobile markets shows that products launched during a recession have both higher long-term survival chances and higher sales revenues. That’s partly because there are fewer new products to compete with, but it also comes from the fact that companies maintaining R&D have focused the investment on their best prospects — which may explain why products introduced during recessions have been shown to be of higher quality.

Timing, of course, is important: Our research shows that the best period to launch a new product is just after a recession’s mid-point. This is when consumers start to think about non-necessities, even expensive products they don’t want to buy yet (such as cars). A new and innovative product engenders hope that the economy is on the mend, and that the consumer may soon be able to afford it.

Even if they don’t have new products ready to bring to market at the right time, smart firms continue to invest in R&D during recessions, which has been shown to have a stronger impact over long-term performance than other categories of marketing spend, such as advertising and price promotion. This is because maintaining R&D means that companies emerge from the recession with a relatively stronger pipeline, particularly in cyclical industries such as automobiles, cement, and steel.

Prices and promotions:Faced with declining sales volume, managers are tempted to increase prices in the hope of maintaining revenues and margins. It’s not hard to see why this is a bad idea: As recessions make consumers more price sensitive, any increase in price will further reduce the likelihood of making a sale, which is why firms that have raised prices soon turn to price promotions to reverse the effect. But the research shows that this see-sawing on price backfires: Firms that engage in it lose more market share than those that don’t.

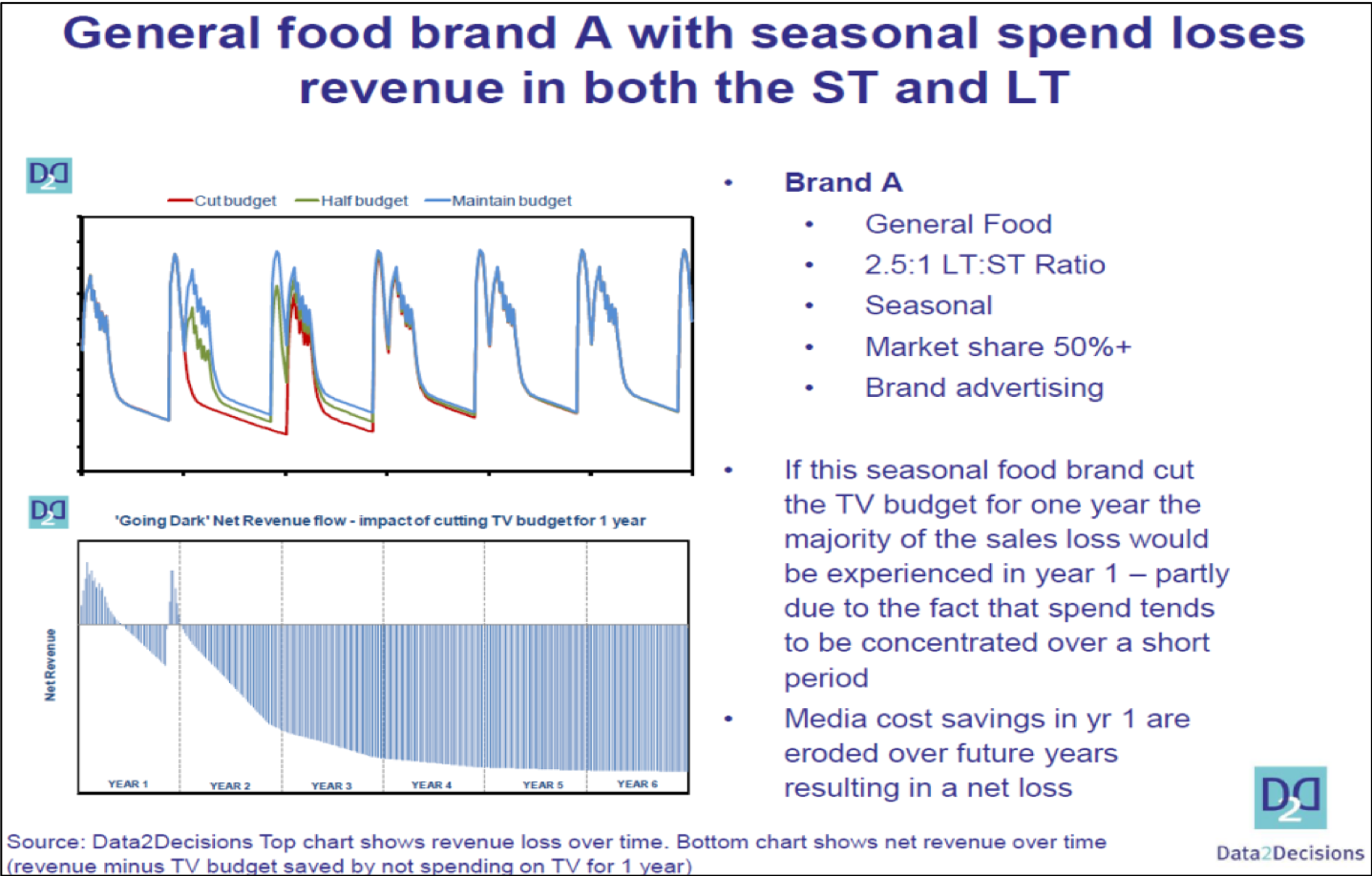

Communication:During recessions, when most firms are cutting back on their brand advertising, a firm’s share of voice increases if it can maintain or increase its advertising budget. Take the case of Reckitt Benckiser: In the recession following the 2008 financial crash, the company launched a marketing campaign aimed at persuading its consumers to continue purchasing its more expensive and better performing brands, despite the harsh economic climate. Increasing its advertising outlays by 25% in the face of reduced marketing by competitors, Reckitt Benckiser actually grew revenues by 8% and profits by 14%, when most of its rivals were reporting profit declines of 10% or more. They viewed advertising as an investment rather than an expense.

The content of advertising during recessions must reflect the challenges that consumers are encountering. Consumers in a downturn want to see brands show solidarity. Successful brand advertising during a recession not only injects humor and emotion, but also answers for consumers the question: How can we help?

Take the case of Coca-Cola. In 2020, the company used its advertising budget to showcase the work of frontline workers, creating mini stories about unsung heroes. The Coca Cola brand features subtly in the background of these messages, reminding consumers that Coca Cola always has been, and always will be there for you, in good times and bad.

A similar tactic allowed Singapore Airlines to demonstrate how its grounded crew was redeployed to helping the community deal with the outbreak. Cabin crew used their skills as care ambassadors. Some helped nurses by taking patients’ vital signs, noting meal orders and serving them. Others worked at transport hubs assisting with crowd control and ensuring compliance with safe distancing guidelines.

Tailoring the response to the context:We all know that a company’s existing branding and size are major factors in how well placed it is to weather and even benefit from a recession. Strong brands are often better able to maintain prices in a recession. At the same time, large companies and smart negotiators can often get price concessions from suppliers in a recession. But how a company’s positioning and capability play out — and what needs to change — will depend on the dynamics of the industry and country in question, which means that companies operating in multiple markets need to choose different strategies for different parts of the business.

Take the case of a one large Russian conglomerate that we advised during and after the 2008 global financial crisis. It operates in six countries and six industries, ranging from mainstream apparel to specialized banking. For its mainstream apparel brand in Russia, the company maintained its advertising budget, while other (mostly foreign) brands simply cut the quantity of messaging and did little to change the content of what they did release. This worked out well for the company because its existing positioning as a local, value-for-money brand appealed to consumers at a time when spending on foreign luxuries felt and looked bad. As the recession receded, many new customers, who had switched from more expensive foreign clothing, stayed with the local brand.

The conglomerate applied a very different approach to its banking operation in Romania. Unlike most of its competitors, our client expected a deep recession and a slow recovery. In this scenario the prospects for getting in new business were poor, and so the company slashed its previously large retail advertising budget and closed a large number of retail branches. This freed up resources so that it could better support existing customers. All customer acquisition efforts, meanwhile, were focused on high net-worth individuals. Its focus on helping existing customers and its careful targeting of new customers helped the bank to grow in the post-recession recovery period.

Marketing in a recession will never be easy, largely because it often involves going against instincts and standard operating norms. Customers’ behavior undergoes profound changes – reflecting changes in their circumstances and needs, which may even be traumatic. In this environment you must accompany your customers on their new, different journey, shifting your message and even re-engineering your value proposition. This is a time not to stop spending money but a time to change how you spend it. It is also an opportunity, because firms who are willing to be what customers need in a recession get to keep many of the new customers they get — and cement the loyalty of those they already had.

1樓. TerranceCash2023/07/15 16:02During a recession, it's crucial not to cut your marketing budget. Hire a trusted digital agency in Malaysia that understands your needs and can help you navigate challenging times. Invest wisely in targeted campaigns, online advertising, and SEO strategies to stay ahead of the competition. Effective marketing can drive growth and ensure your business thrives, even during economic downturns. Choose a reliable digital agency in Malaysia to maximize your marketing efforts.(jackelliott.jack@yandex.com)

1樓. TerranceCash2023/07/15 16:02During a recession, it's crucial not to cut your marketing budget. Hire a trusted digital agency in Malaysia that understands your needs and can help you navigate challenging times. Invest wisely in targeted campaigns, online advertising, and SEO strategies to stay ahead of the competition. Effective marketing can drive growth and ensure your business thrives, even during economic downturns. Choose a reliable digital agency in Malaysia to maximize your marketing efforts.(jackelliott.jack@yandex.com)