Russia crude oil pipeline capabilities to mainland China—The ESPO crude oil pipeline

- In the case of pipeline supply disruption to Europe, Russia needs to look to alternative markets in Asia, given that it has no strategic petroleum reserve (SPR) system.

- Insufficient crude oil pipeline transmission capacity will limit how much additional oil Russia can send to mainland China.

- Mainland Chinas demand for Russian crude will remain stable since local refineries favor the ESPO blend.

The possibility of a supply disruption to Russian oil owing to the Russian-Ukraine crisis has caused a physical and financial shock to the global crude oil market. Russia is a significant crude oil exporter in the world, although it is the third-largest oil producer after the United States and Saudi Arabia. Preinvasion Russian crude oil exports were approximately 4-5 MMb/d. Currently, Russian crude oil exports have reduced, and further reductions are likely. Understanding the crude oil disposition capacity and capability is important as the situation evolves post-invasion in the global crude oil market. What are the current crude oil pipeline disposition outlets and what are the possible implications from further reductions in Russian crude oil exports?

The disposition of crude oil from Russia has several outlets. A critical outlet for Europe is via the Druzhba pipeline. The Druzhba pipeline delivers crude oil from Russia to Poland and Germany through Belarus, Hungary, Slovakia, and Czech Republic via Ukraine. However, if the situation escalates further and impacts Russian crude oil exports, where can the surplus Russian barrels go? Are there alternative routes that Russia can redirect the pipeline flow to beyond Europe? Is incremental offtake to the east and mainland China an option?

The following map illustrates existing Russian oil related infrastructure, highlighting oil pipelines, refineries, and oil storages that are currently operating. For level setting purposes, Russia has an export capability of 11 MMb/d for crude oil and refined products, and a total operating oil storage capacity of 96.8 MMbbl. The largest crude oil storage is the 10.6 MMbbl Omsk Refinery owned by Gazprom Neft, followed by a 7.3 MMbbl Novorossiysk Marine Terminal, owned by Caspian Pipeline Consortium. However, Russia does not own and operate an SPR. While an SPR enables a country to stock up crude for times of supply shortage, it also can in this circumstance, soak up the immediate surplus. Without SPR, Russia theoretically has less supply flexibility and can only manage downstream consumption decreases by production cuts. Correspondingly, if the Russian crude oil exports are reduced, alternative outlets are minimal to nil in-country..

.

傳聞中國建議重新探勘,在蒙古國境內950公里的西伯利亞力量二號管道區域,傳聞中國要求派遣安全人員進駐於施工期間以及竣工後的維修,保養,巡邏等事項,蒙古國則傳出每立方公尺天然氣的過路費要增加為30 美元?

國際戰略觀察家認為,蒙古國最後會妥協答應中國的要求,畢竟蒙古國不會讓每年約為30億美元的過路費失去,不拿白不拿,至於中國派遣安全人員進駐蒙古國的費用及相關支出,都是由中國支付,反而有利,傳聞950公里的天然氣管道,需要每隔50 公里設置1座觀察站,提供安全人員,天然氣工程師以及相關人員及設備進入, 也就是說有利於天然氣沿線的開發經濟效益,對於蒙古國有利.

才造成建設工程延後開工的事件?.國際戰略觀察家認為中國考慮周詳,為防止蒙古國內的恐怖份子(蒙古獨立組織接受美國及西方國家支援)暗中破壞及炸毀在蒙古國境內950公里的西伯利亞力量二號管道事件發生.中國亦步亦趨有副案可以變更西伯利亞力量二號管道不經過蒙古國境內.

..

..

Gazprom shuts down pipeline, suspends gas exports to China.

Power of Siberia gas pipeline has been down for a week for a scheduled turnaround.?

根據西方國家的情報顯示出西伯利亞力量天然氣管道2號預計全長3550公里,其中有950公里穿越蒙古國領土,中國建議必須重新探勘部份管線經過的地區,原因就是中國不信任蒙古國的承諾保證施工期間的安全以及管線竣工後的維修保護以及緊急狀況下的搶修工作,中國執意要全面依照中國的標準作業標準執行,甚至於派遣所謂的安全人員, 24 小時巡邏守護,在蒙古國境內的西伯利亞力量2號天然氣管道,雖然目前科技監測系統設備先進,但是扔然需要安全人員的例行的巡邏,以免意外狀況發生 其實中國真正擔心的是蒙古獨立的恐怖份子會肆意的破壞及炸毀在蒙古國境內的西伯利亞力量二號管道,國際觀察家分析中國依然會派遣安全人員常駐於管線附近的:"觀察站".

但是俄羅斯副總理(Viktoria Abramtschenko從俄羅斯途徑蒙古國向中國輸送天然氣的"西伯利亞力量二號管道"蒙古部分的建設將於2024年第一季度或上半年開始 施工建設?

蒙古國總理(Luvsannamsrai Oyun-Erdene)表示,"西伯利亞力量二號管道"的工程建設可能面臨延遲開工?

.

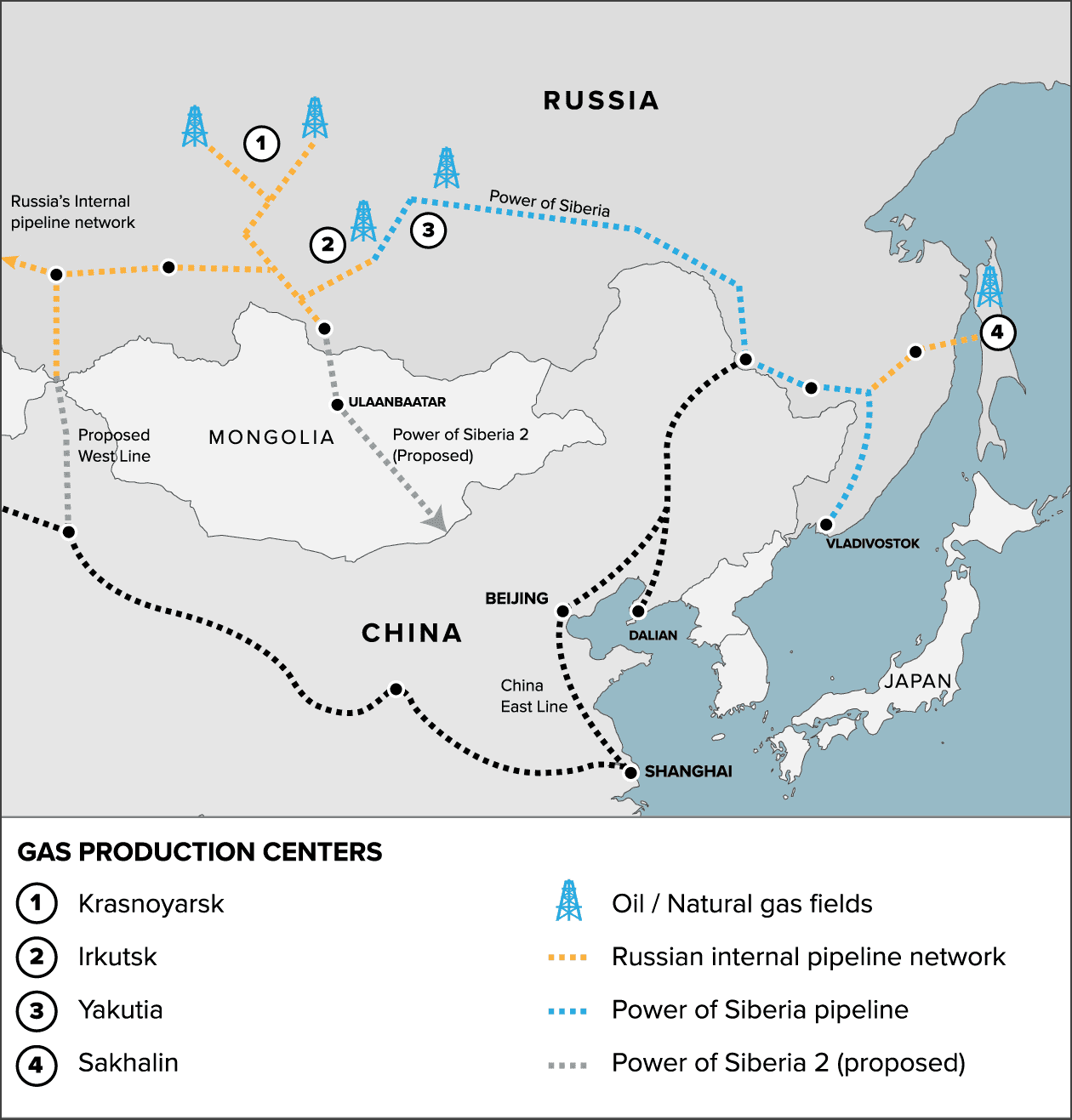

Russia-China gas pipeline faces construction delays.The Power of Siberia 2 pipeline has been a priority for Russia for more than a decade..

.The Power of Siberia 2 pipeline could bring an additional 50bcm of gas from fields in western Siberia to China. Prior to Russia’s invasion of Ukraine, the Yamal peninsula had supplied gas to Europe.

T.he beginning of construction on Russia’s mega-pipeline, which would see the country’s western gas fields connected to China, is expected to face delays, Mongolia’s Prime Minister Luvsannamsrain Oyun-Erdene has warned.

The Power of Siberia 2 pipeline, due to be operated by Russian oil and gas company Gazprom, has been a priority for Russia for more than a decade. However, Europe’s sanctioning of Russian energy products after its invasion of Ukraine has elevated its importance to Moscow to new heights.

Oyun-Erdene had previously told the Financial Times (FT) that he expected construction of the 3,550km pipeline, which will stretch 950km through Mongolian territory, to begin in 2024. When asked by reporters whether Gazprom and China National Petroleum, the two companies involved in the project, will stick to that timetable, he said that Russia and China are yet to agree on critical details of the mammoth infrastructure project.

“Those two sides [Russia and China] still need more time to do more detailed research on the economic studies,” Oyun-Erdene said in an interview with the FT, adding that record global gas prices during the past two years had complicated negotiations. “The Chinese and Russian sides are still doing the calculations and estimations and they are working on the economic benefits.”

Russia’s Deputy Prime Minister, Alexander Novak, said on Thursday that timings for construction will be finalised after Chinese partners sign binding agreements. In September last year, Russia claimed the route for the Power of Siberia 2 pipeline had been finalised.

China already receives gas from Russia through the original Power of Siberia pipeline. It was built in 2019 but is not expected to reach full capacity until 2025. Last year, the interconnector carried approximately 23 billion cubic metres (bcm) of gas to China; this is expected to rise to around 38bcm next year..

中國及俄羅斯合作建設西伯利亞力量二號管道"一旦建成,預計每年從俄羅斯經蒙古國向中國輸送500億立方米天然氣,幾乎相當於目前閒置的俄羅斯和歐洲之間的北溪1號之前的輸氣量。鋪設在波羅的海海底的北溪1號NS1.輸氣管道2022年9月被炸受損。換句話說俄羅斯扔然可以從中國天然氣市場彌補損失而且長久安全.

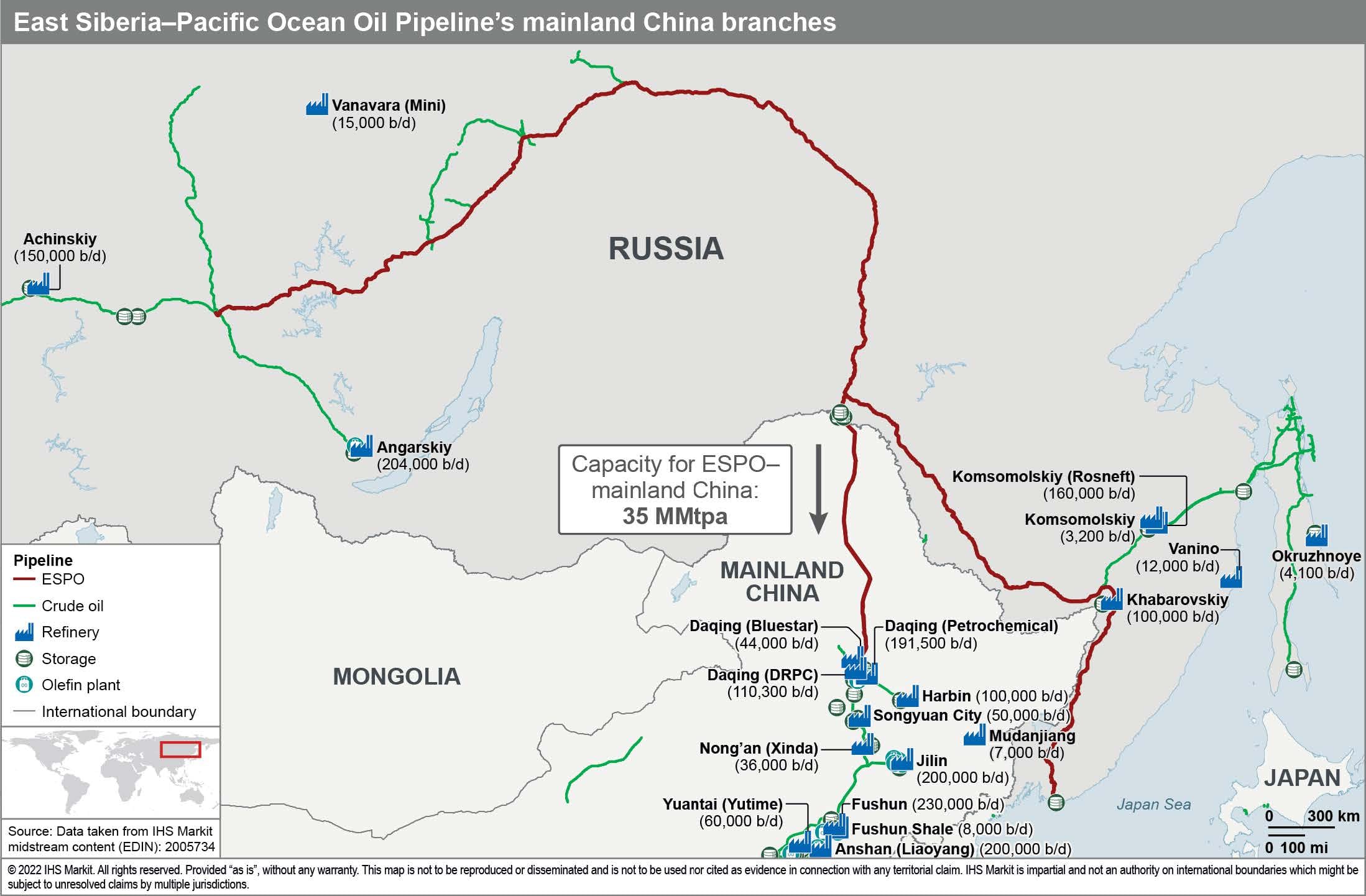

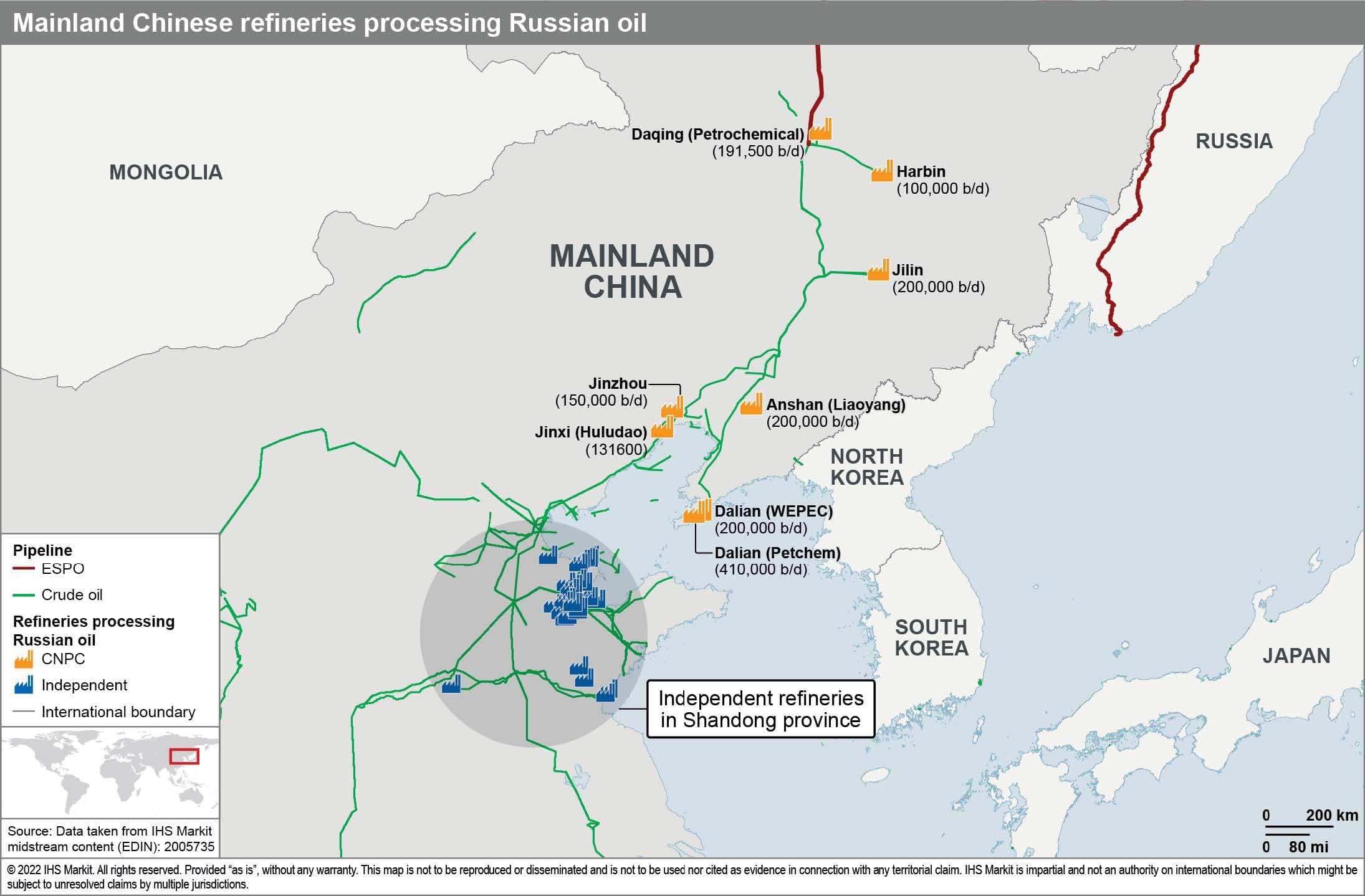

..The estimated ESPO oil pipeline capacity for deliveries to mainland China for Russian oil is approximately 35 MMt/y, higher than the 30 MMt/y designated by the supply contract. Assuming the volumes available are more than the pipelines capacity, mainland China traders have the ability in an unconstrained world to import ESPO blend taking waterborne. The ESPO oil pipeline crude blend is favored by mainland China refineries, particularly refineries in the Northeastern provinces, and the tea-pot refineries in the Shandong province. The following map shows pipeline connections with CNPC refineries and tea-pot refineries in Shandong.

CNPC has recently upgraded its Daqing Petrochemical refinery to process 3.5 MMt/y of Russian Oil. The refinery joined the existing fleet with Dalian Petrochemical, Liaoyang, Jilin, Jinzhou, Jinxi, Harbin, and WEPEC. These refineries process ESPO blend with indigenous oil production, with the ESPO portion ranging at 15-50%.

Mainland China has currently a total of 38 independent or so-called tea-pot refineries with a combined capacity of 2.53 MMb/d, approximately 126 MMt/y. This figure excludes those refineries that have been acquired by large companies such as by ChemChina and Norinco. ESPO is the blend at these refineries, followed by the Urals. IHS Markit research shows ESPO import ranges from 1.5-2.5 MMt per month via ports at the Shandong coast.

In summary, we believe that the ESPO pipeline is a critical route for Russian oil to reach its key consumer, mainland China. However, this pipeline seems to be at its capacity even before the Russia-Ukraine crisis, and it is unlikely for Russia to be able to increase its existing supplies to mainland China via this route. The other pipeline, the Atasu-Alashankou Pipeline, has limited spare capacity. The insufficiency in oil transmission capacity will force Russian barrels to take sea routes to mainland China if Russian ships continue to be diverted from countries that have imposed self-sanctions on Russian crudes. Chinese demand for seaborne Russian crude—particularly the ESPO blend and Urals—will remain stable because these are the preferred grades run by most of the independent/large refineries that are owned and operated by national oil companies.

.

.

限會員,要發表迴響,請先登入